Since July 2023 you have the possibility to set prices and tax rates in your item list via the folders. These can then be inherited by the items in the folder.

This is how it works

Step 1: Set prices and tax rates in the folder.

- In your MINI, go to Menu > Item list > Folder.

- Create a new folder or tap on one to edit it.

- Now, in addition to name, color and DATEV accounts, you also have the fields for prices and tax rates, both In-House and Take Away (or only one if you have deactivated the switch: Customize or hide "In-House" & "Take Away" ordering methods ).

- Enter price and tax.

- And at the top, click on [Save].

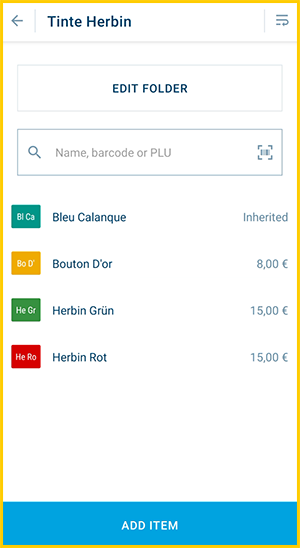

- Now, you can inherit these prices and tax rates to items in this folder - but you don't have to. You decide which items should inherit from the folder, and for which you store your own data. If an item should inherit, then it continues with ...

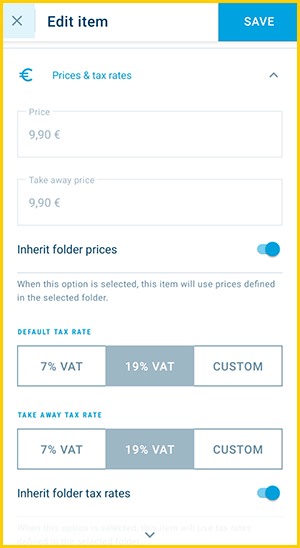

Step 2: Activate the inheritance in the product settings.

- Create a new item or tap on one to edit it. For new items, first enter the General Information.

- Then go to "Price and tax rates". Here you can enter your own values or activate the inheritance slider under the fields.

- Remember that…

- You can only inherit from the folder the item is in.

- You can inherit prices and tax rates separately. I.e. if you want to inherit both, both inheritance sliders must be activated.

- If all other settings fit, tap on [Save] at the top.

- Done!

By the way: the category and product settings are explained in detail here: Step 4 - Add your item list: Folders and items.

Note for Small Businesses

If you operate a small business (e.g., under § 19 of the German VAT Act), you do not charge VAT on your sales. This means you should set all tax rates in your POS system to 0%.

The easiest way to do this is by setting the tax rate to 0% in your categories and allowing your products to automatically inherit the tax rate from the assigned category.

Please also consult your tax advisor to determine which wording must appear in the footer of your receipts to properly indicate the VAT exemption.

You can learn how to edit the footer of your receipts in the POS system here: Customize Your Receipt and Keep It Up to Date

Regarding Legal and Tax Advice

Regarding Legal and Tax Advice

Please note: orderbird does not provide legal or tax advice!

Everything we write reflects our experience and the experiences of our customers. Any information related to legal or tax aspects should not be considered legal or tax advice under any circumstances. Therefore, a procedure we describe may not be applicable to you or your business specifically.

For definitive statements, please consult your tax advisor. orderbird disclaims any liability for the accuracy, correctness, and completeness of the information provided here regarding tax-related procedures.